How Can a Personal Loan Help You Improve Your Credit Score?

When it comes to determining your financial health, lenders rely on your credit score in a big way. The better your credit score, the easier it is for you to get approved for a line of credit. In fact, an excellent credit score means you can avail the lowest interest rates when you borrow, as you are perceived as a low-risk borrower. On the other hand, a poor credit score could affect your ability to get loans even in times of emergency.

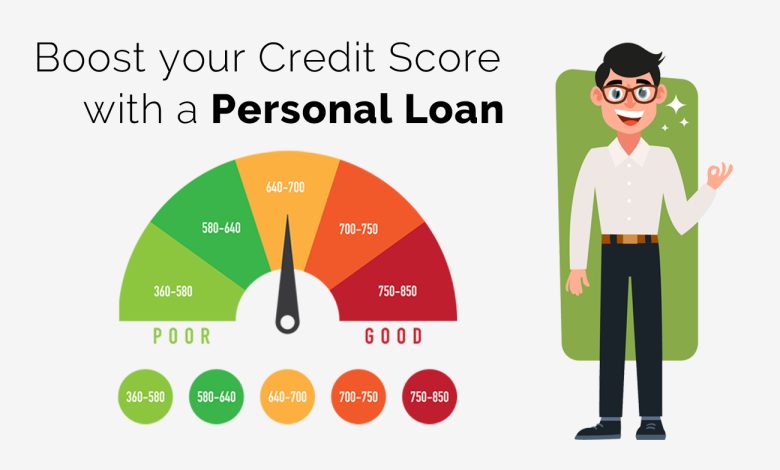

In this post, we find out why you need personal loans to improve your credit score. But first, let’s understand the different ranges of your credit score.

Ranges of Credit Scores

A credit score is calculated out of 900. Here are the different categories your credit score might be classified into:

| Credit Score Range | Grade |

| 0 or -1 | No Credit History |

| 500 – 300 | Bad |

| 551 – 649 | Poor |

| 650 – 699 | Fair |

| 700 – 749 | Good |

| 750 or above | Excellent |

What Factors Decide Your Credit Score?

- Your Credit History: This exhibits your repayment history and your reliability for repaying a debt.

- The Length of a Loan: The longer your loan tenure, the better your chances of good credit scores.

- Your Debt Amount: Having a high balance to be repaid will affect your credit scores.

- Any Failures to Repay Your Credit Dues: If you have not repaid any loan dues on time, your credit scores will falter.

- Current Loans: The repayment history of any current loan is considered too.

How Can a Personal Loan Help You Improve Your Credit Score?

To make sure you can take out a line of credit at any moment, you must aim to keep your credit scores 750 or above. There are several ways for you to improve your credit scores including taking out a personal loan.

Why Do You Need Personal Loans for a Good Credit Score?

- You can use a personal loan to pay off existing debts. You need personal loans on low-interest to clear any past loans you haven’t finished paying your dues for.

- You need personal loans to improve your credit scores if you have had past credit debts or unpaid loans. Paying back the new personal loan in instalments will lead to a good addition in your credit history.

- A personal loan improves your available credit to debt ratio– also called the ‘utilisation ratio’. This ratio is responsible for about 30% of your credit scores.

What to Remember When Taking Out a Personal Loan to Improve Your Credit Score?

- Choose a personal loan option your finances support without trouble.

- Try not to apply for multiple loans at once. It might make you seem like a credit hungry person to a lender. Plus, a personal loan rejection might even reduce your credit scores.

- If you need personal loans to repay previous loans, choose the amount for the new loan carefully. This is to make sure you can repay it with ease.

- You may use an EMI (Equated Monthly Instalment) calculator to know how much you would need to repay every month for a particular loan. Ensure it is not more than 40-50% of your NMI (Net Monthly Income).

- Make a habit of repaying your loan instalments on time through the loan tenure. This is important since not doing so will also affect your credit scores.

- However, do not pay before your loan matures either. A longer credit history is considered superior by lenders. Therefore, you should keep making regular payments over a significant time period.

- An improving credit score will make you eligible to take out various other loans. Despite the opportunities, try not to hurry and take out unnecessary loans.

Personal Loan Documents:

The usual documents needed to take a personal loan in India would include:

- PAN card

- Address proof

- Identity proof (Aadhaar card, Passport, Voter ID, Driver’s licence etc.)

- Bank statements of the past six months

- Salary slips for the past three months (only for salaried individuals)

- Income tax returns (only for salaried individuals)

While a personal loan can work wonders for your credit scores, there may be a drop in your credit score right after you take one out. This is because a new loan will signify new risks. Make sure to pay your set monthly instalments on time and avoid needless new loans.